Scope of IEC Code

The Import Export Code (IEC) registration is a mandatory registration process for businesses engaged in the import and export of goods and services in India. The scope of IEC Code registration in India is significant, as it provides businesses with several benefits and opportunities.

One of the primary advantages of IEC Code registration is that it enables businesses to expand their operations globally by engaging in international trade. With an IEC Code, businesses can import and export goods and services without any restrictions and enjoy various benefits such as customs exemptions, export incentives, and easier access to export finance.

Moreover, IEC Code registration is mandatory for businesses that want to avail of various export promotion schemes offered by the government, such as the Merchandise Exports from India Scheme (MEIS) and the Service Exports from India Scheme (SEIS).

Another benefit of IEC Code registration is that it provides credibility to businesses and enhances their marketability, which can help them to attract more customers and grow their operations.

Furthermore, IEC Code registration is a one-time registration process, and businesses do not need to renew it every year, which makes it a hassle-free and cost-effective registration process.

Additionally, businesses that have an IEC Code can also take advantage of several benefits provided by the government under various trade agreements, such as reduced tariffs, easier access to markets, and protection of intellectual property rights.

Want to Apply for IEC Code?

India License shares information on Import Export IEC Code Registration, Types, Validity, Eligibility, Documents, Guidelines, Fee, Registration Process and where to Apply! For those who wish to Register for an IEC Code this will certainly help.

What is an IEC Code?

An Importer -Exporter Code (IEC) is a key business identification number which is mandatory for export from India or Import to India. No export or import shall be made by any person without obtaining an IEC unless specifically exempted.

What is IEC Code for?

An Importer – Exporter Code (IEC) is a key business identification number which is mandatory for export from India or Import to India.

IEC (Import Export Code) is required by anyone who is looking to kick-start his/her import/export business in the country.

No export or import shall be made by any person without obtaining an IEC unless specifically exempted.

Benefits of IEC Code

IEC assists you in taking your services or product to the global market and growing your businesses.

The Companies could avail several benefits of their imports/ exports from the DGFT, Export Promotion Council, Customs, etc., on the basis of their IEC registration.

Validity of IEC Code

IEC does not require the filing of any returns. Once allotted, there isn’t any requirement to follow any sort of process for sustaining its validity. Even for export transactions, there isn’t any requirement for filing any returns with DGFT.

Who can get IEC Code?

Any Proprietorship, Partnership, LLP, Limited Company, Trust, HUF and Society can apply for IEC.

Individuals can use either the name of their company or their name directly to apply for IEC.

Exemptions

If import or export is made for personal use or is made by government department then no IEC is required.

According to the latest circular issued by the government, IEC is not mandatory for all traders who are registered under GST. In all such cases, the PAN of the trader shall be construed as a new IEC code for the purpose of import and export.

Who issues IEC Code?

It is issued by the DGFT (Director General of Foreign Trade).

It is fairly easy to obtain IEC code from the DGFT within a period of 10 to 15 days after submitting the application.

There isn’t any need to provide proof of any export or import for getting IEC code.

Mandatory Requirements

To apply for an IEC, PAN, bank account & valid address in the name of the firm is mandatory.

Address may be physically verified by the DGFT on issuance of the IEC. Please keep your PAN, bank details and firm details ready before applying.

Validity of IEC Code

IEC is a 10-digit code which has lifetime validity.

IEC code is effective for the lifetime of an entity and requires no renewal. After it is obtained, it could be used by an entity against all export and import transactions.

Documents required for IEC Code Registration

- Individual’s or Firm’s or Company’s copy of PAN Card.

- Individual’s voter id or Aadhar card or passport copy.

- Individual’s or company’s or firm’s cancel cheque copies of current bank accounts.

- Copy of Rent Agreement or Electricity Bill Copy of the premise.

- A self-addressed envelope for delivery of IEC certificate by registered post.

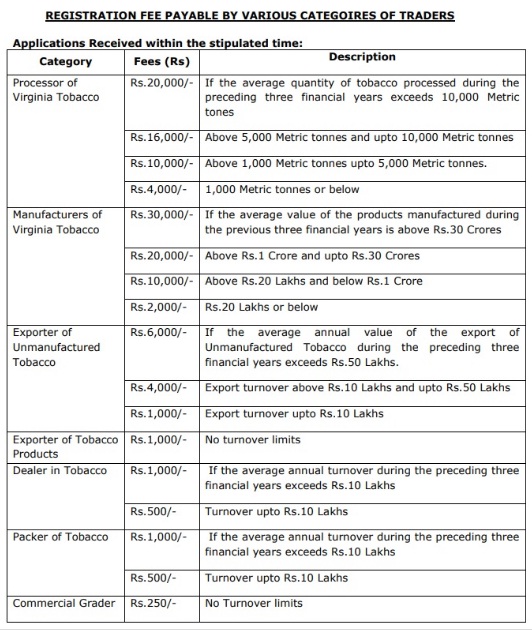

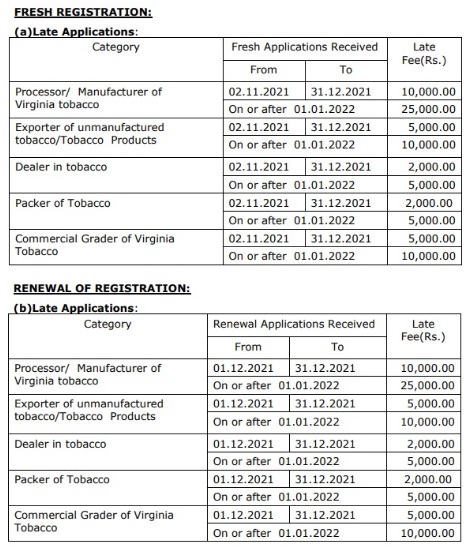

Registration Fee

IEC code number registration fee is worth Rs.250.00

It can be paid via EFT (Electronic Fund Transfer), when submitting IEC Online Application form.

How to apply for IEC Code Registration Online?

To apply for IEC (Import Export Code) registration online in India, you need to follow these steps:

- Visit the Directorate General of Foreign Trade (DGFT) website at https://www.dgft.gov.in/.

- Click on the “IEC” tab on the main menu.

- Select the “Online IEC Application” option.

- Fill out the online IEC registration form with all the required details, such as personal information, company details, and bank details.

- Upload all the supporting documents required with the application, such as proof of identity and address, PAN card, and photographs.

- Pay the IEC application fee online through the DGFT portal.

- Submit the completed registration form and documents online.

- Wait for the DGFT administrator to process your application, which can take around 2-3 days.

If your application is approved, you will receive an IEC registration certificate from the DGFT administrator, which will allow you to import or export goods and services in India.

Where to download the IEC Code Registration application form?

You can download the IEC (Import Export Code) registration application form from the Directorate General of Foreign Trade (DGFT) website in India. Here are the steps to download the application form:

- Visit the DGFT website at https://www.dgft.gov.in/.

- Click on the “IEC” tab on the main menu.

- Select the “Download” option.

- Select the “IEC Forms” option.

- Click on the “IEC Application Form” button.

- The IEC application form will be downloaded in PDF format.

- Open the downloaded PDF file and print the application form.

- Fill out the application form with all the required details, attach the supporting documents, and submit it to the nearest DGFT office.

Note: The IEC registration application form in India may be subject to change, so it is recommended to check the DGFT website for the latest version of the form before submitting your application.

How to get IEC Code Registration?

- You need to visit : https://www.dgft.gov.in/CP/

- Click on the ‘Services’ tab on the homepage.

- Select the ‘IEC Profile Management’ option from the drop-down list.

- A new page will open. Click on the ‘Apply for IEC’ option on the page.

- Click on the ‘Register’ option. Enter the required details and click on the ‘Sent OTP’ button.

- Enter the OTP and click on the ‘Register’ button.

- Upon successful validation of the OTP, you will receive a notification containing the temporary password which you can change after logging into the DGFT website.

- After registering on the DGFT website, login to the website by entering the user name and password.

- Click on the ‘Apply for IEC’ option on the DGFT website.

- Fill the application form (ANF 2A format), upload the required documents, pay the required fees and click on the ‘Submit and Generate IEC Certificate’ button.

- The IEC code will be generated by the DGFT. You can take a printout of your certificate once the IEC code is generated.

How can I print my IEC certificate?

- You can take print out of your IEC certificate by the below process:

- Visit the DGFT website – https://www.dgft.gov.in/CP/

- Click on the ‘Services’ tab on the homepage.

- Select the ‘IEC Profile Management’ option from the drop-down list.

- A new page will open. Click on the ‘Print IEC’ option on the page.

- Verify your details and click on the ‘Print IEC’ button.

IEC Code Reference Videos

Here are some videos related to IEC Code which offer in-depth information on how to apply for an IEC Code in India.

What is IEC Code?

Validity of IEC Code

Exemptions for IEC Code Registration

Documents required for IEC Code Registration

IEC code Registration Fee

How to register IEC code Online?

How to take a print out of your IEC certificate?

Complete Guide to IEC Code Registration

Related Topics:

Exemptions for IEC Code Registration

Documents required for IEC Code Registration

How to register IEC code Online?

How to take a print out of your IEC certificate?

Complete Guide to IEC Code Registration

TOP 5 IEC Consultants in India

Hiring an experienced IEC Consultant can help you save time and efforts and get an IEC Code Registration without a hassle in stipulated time period.

IEC Code Online – Call: 9540695222, 7835076676 – https://www.ieccodeonline.com

Registration Filing – Call: 9266662243 – https://www.registrationfiling.com

Abhi Filings – Call: 8553512415 – http://www.abhifilings.com

Legal Docs – Call: 9022119922 – https://legaldocs.co.in

WeR Consultants – Call: 7715923881, 8767805809 – https://www.werconsultants.com

Why is it important to connect with the right IEC consultants?

A knowledgeable and professional consultant has years of experience procuring IEC Code, registration process, preparing documents, using proper formats, avoiding common errors and supporting clients and this expertise can certainly help your business. India License connects you with BEST IEC consultants. People who know what they are doing and do it well. They deliver results. Period.

Customer Reviews

Providing the right information, latest updates, helping with documentation and paperwork, applying for the IEC Code and getting it ensures customer satisfaction. Here are some reviews that underline the commitment and professionalism of these Consultants..

How to Find the Right IEC Consultant?

- Don’t fall into Free Consultation Trap. Some ask you to add a 5 star review to their fake business listing to make it look legit. Refuse. It will harm others.

- Don’t trust blindly. Read Business Reviews from others. Seek References – real people with phone numbers. Call them, seek their opinion.

- Find out if they have an office. Visit their office, meet in person, check credentials before making a decision.

- Find out if the consultancy business is registered. Make sure, their business is legitimate! If not registered, walk away, period.

- Avoid, random, work from home, smooth talking, self proclaimed honest story weaver consultants selling IEC Code for lowest prices!

- Take your time. Compare a number of consultants before you make a decision.

- Don’t make payment till you get your IEC Code. Have it all checked, be double sure before you make the payment.

Is it absolutely necessary to find a consultant to get IEC Code?

No, you will find all the relevant information on this website to apply for the IEC Code on your own. Of course, it will take some effort and time to go through it, but it will save you good amount of money and also make you smarter. Remember – consultants are people like us. You can do, what they can do. Just go through the information given and apply online. It is not at all difficult.